Helping you steer through car insurance jargon

Posted by LStevenson

on

At esure, we like to try and keep things simple, so we believe in demystifying car insurance (and de-misting car windows, for that matter). We want to help you make informed decisions about the right level of cover for you, and understand the terms you might come across in your journey. So, without all the hot air (except what’s needed for those misty windows), here are some common car insurance terms, explained.

INSURANCE SCHEDULE

This is one of the main documents you receive once you take out a car insurance policy. It includes all the information about your cover and the details you've given to your insurer. It’s important to check that all details you supplied are correct, as if they’re not it could mean your insurance isn’t valid and could be cancelled.

EXCESS

This is the amount of money you would need to pay to the insurer, over and above your Premium, towards the total cost of a claim should you need to make one. There are two main types of excess – Compulsory, which you can’t change and is set by your insurer, and Voluntary, an additional amount that you may be able to agree with your insurer to lower the cost of your Premium. You should always make sure you can afford the total amount of both excesses combined should the worst happen and you need to pay it. The amounts for each excess will be shown in your Insurance Schedule, as well as any different excess amounts for the different types of claims.

PREMIUM

This is the amount paid by the policyholder (you) to the insurer (us) for the policy.

UNDERWRITER

Underwriters are individuals who help insurers decide the risk they are taking, and then how much to set your Premium at. This is based on statistical trends and taking into account things like the age or value of your car, and how you use it. At esure, this is done in-house by our great team of Underwriters, but it can be done by external companies. Fun* fact: the term comes from the old practice of each risktaker literally writing their name under the total amount of risk.

*depends on your definition of fun, of course; but we get excited by insurance.

*depends on your definition of fun, of course; but we get excited by insurance.

ENDORSEMENTS

An Endorsement just means anything added or different to the standard terms in your policy booklet – for example, if your specific policy doesn’t include cover for driving other cars. These will be shown in your Insurance Schedule.

EXCLUSIONS

Exclusions are things specifically not covered by your policy. Helpfully, your policy booklet will list them under the headings ‘What isn’t covered’, and ‘General exceptions which apply to this policy’, such as damage caused to your car by a pet when they’re in your car.

LIABILITY COVER

As the name suggests, Liability Cover provides ‘cover’ if you are found ‘liable’, or to blame in an accident with another person; paying out for any costs to repair damage to their car and/or medical expenses if they’re injured.

TOTAL LOSS

If you’ve ever heard someone describe a car as ‘written off’ or ‘totalled’, this is what they mean. It’s when your car is totally destroyed or damaged to the extent that it would cost more to repair than to replace it.

NO CLAIM DISCOUNT

When you don’t make any claims on your insurance each year, you are usually eligible for a discount (or ‘bonus’) on the cost of your policy.

USAGE CLASS

This refers to the different ways someone might usually use their car - which is something that’s taken into account when calculating your Premium. These include Social, Domestic and Pleasure which covers you for driving to the shops, seeing friends etc. If you commute to just one place of work using your car, then ‘commuting’ would need to be added to your cover, and if you use your car for business (like visiting multiple clients or offices) then ‘Business use’ would need to be included. It also includes whether it’s just you, or other drivers using the same car. You can find out more about the different types of use by watching our video

HIRE OR REWARD

This refers to using your car for profit; like a taxi or delivery driver. This is different from other Usage Classes, and isn’t covered by a standard policy, so anyone looking to earn money from their car would need to get specialist insurance.

GAP INSURANCE

Guaranteed Asset Protection insurance pays the difference (or the ‘gap’) between a pay-out you receive from your insurance company after a successful total loss or stolen and not recovered claim, and the value of your car when it was bought. It’s mostly associated with new cars, but can also be bought for second-hand cars under 7 years old.

MARKET VALUE

This is the value your car would have held on the open market, if you had tried to sell it just before your accident or loss (written off, or stolen and not recovered). This is worked out by looking at what vehicles of the same make and model, similar age, condition and mileage are currently selling for.

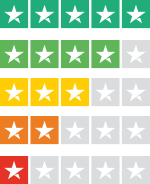

DEFAQTO

Defaqto is a leading financial information, ratings and fintech business. Its Star Ratings help consumers make better informed financial decisions.

You might also be interested in

Understanding your car cover and when it applies

Check out our video for top car cover tips.

A modern take on age old insurance

From the ancient Babylonians to flying cars...

We'd really like to hear your views

Let us know how we’re doing – after all what matters to you, really does matter to us.